Under the guise of tech companies, Disney, Netflix, YouTube, Apple, Amazon, Twitch, are for all intents and purposes TV companies using technology as a pick to unhinge the TV

In the early 1990s, Sky entered the UK proposing a new model for managing and marketing the television rights to premier league soccer. Sky sensed, earlier and better than others, that the subscription-based model would be more profitable than the pay-per-view system and used technology as a picklock to unhinge the traditional TV vault. It is obvious that an operation of this caliber required state-of-the-art technology, and in fact the decoder worked well, the GUI was a substantial improvement over existing operators, and even the customer support was effective. However, technology was not the cause of Sky’s success but only a tool to support a new way of thinking about the marketing, distribution, and enjoyment of quality content.

History repeats itself, to err is human, to persevere is diabolical, but for some absurd reason in the world of TV we often relapse. I spent almost ten years as a manager at Google, four of them in Silicon Valley, too many to not realize that Disney, Netflix, YouTube, Apple, Amazon, Twitch are not tech companies but simply TV companies that use technology to take apart and rebuild the new TV.

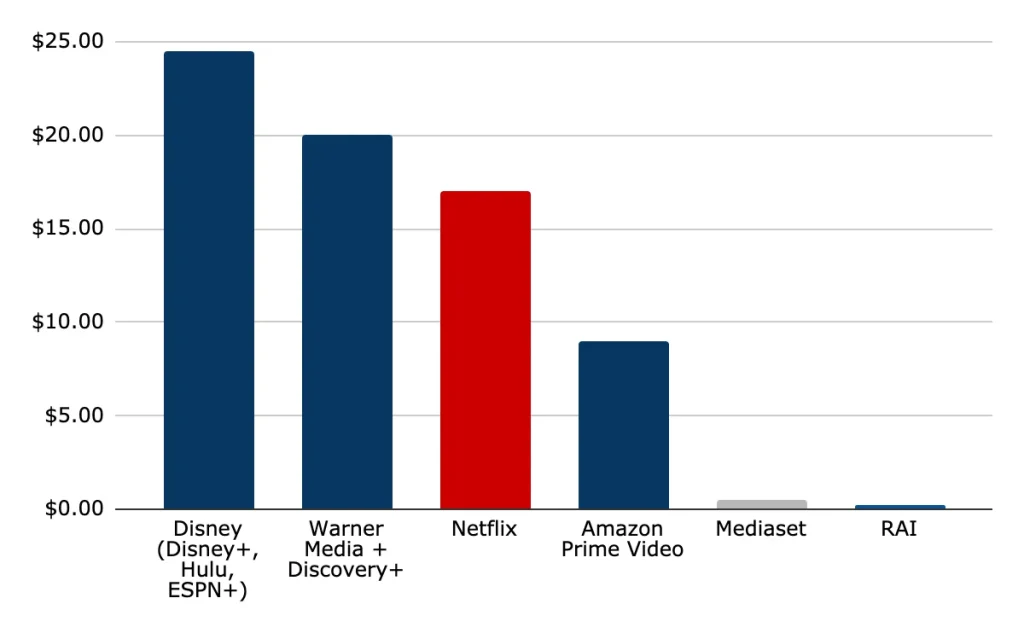

Take the Netflix case, there is no doubt that technology has contributed substantially to the success of the platform, the app works like no competitor, the search engine is effective, the suggested movies are more or less fitting, and users are on average satisfied. However, it is clear that Netflix would not be as successful as it is if it did not offer appealing content to users, and it is no coincidence that it is on content (not technology) that the battle for dominance of the new TV is being played out. By 2021, Netflix will spend nearly $17 billion on original content, in a competition that has Disney leading the way with investments of more than $25 billion on its own proprietary platforms Hulu, Disney+ and ESPN+. By contrast, in FY 2020 our national broadcasters, Mediaset and RAI recorded investments of just €430M and €180M respectively, far too little to represent a credible alternative in the digital TV era. The scale of investment by U.S. giants is but a confirmation of how Disney, Netflix, YouTube, Apple, Amazon, Twitch, do not operate as tech companies Using TV to get into other businesses. TV is their business Indeed, the real TV is them.

Investment in original content (in billions of dollars)

To give an idea of the magnitude of the OTT phenomenon, I step away from TV for a moment to talk about a $1 trillion industry, logistics. In 2013, Flexport was born in San Francisco, with the goal of digitizing the transoceanic transportation industry, making it traceable, transparent and understandable to all. The idea starts from the same assumptions as Netflix’s, namely to use technology as a pick to subvert the order of an elephantine industry in which none of the companies leader was born after 1994. Until the arrival of Flexport, the giants in the logistics industry had neither the expertise nor the will to track and share the movement of goods through the various stages of the supply chain in real time, because access to this kind of information would bring to the surface all the opacities and inefficiencies (always borne by the customer) of an entire industry. The refrain is always the same, the technology already existed, the incentives and willingness to improve did not. Flexport of its own put in the idea and courage, the magical world of Silicon Valley did the rest. In less than 8 years, Flexport has raised $1.4 billion (with a $1 billion D round in 2019 led by the usual SoftBank Vision Fund) to build the new logistics giant , which has already garnered nearly 2,000 customers and will undoubtedly become the first freight forwarder in the world in the next ten years, Amazon permitting.

Flexport Capital Raised Flexport Evaluation

Thus, the myth of OTTs as tech companies has been dispelled, what is left of the traditional media industry in general and specifically, in Italy? At best little, at worst almost nothing. If it is fair to ask how traditional broadcasters, rather than freight forwarders, can or automakers at the time of Tesla and NIO, compete in this new market with a fraction of the resources (Amazon has $73 billion in cash reserves) and technological expertise that OTTs have accumulated in recent years, it is equally fair to expect that the answer to these questions will once again pertain to the TV field rather than the technology field. Technology is now a commodity, and in the case of TV, the creation and distribution of original content will be crucial factors in securing relevant market share.

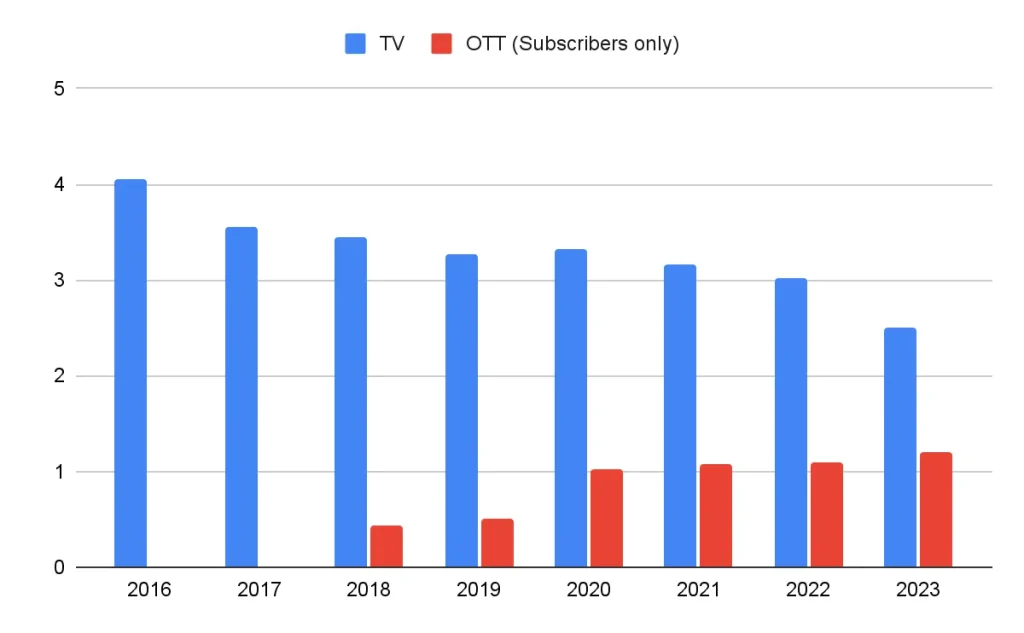

In this sense, the lockdown over the past two years has exposed the content shortage of traditional broadcasters, prompting users to rely on paid services to meet the growing need for original content. The result has been a substantial increase in dwell time on OTT platforms at the expense of old TV. In the U.S., time spent on OTT has already reached 30 percent of television time, and in the most conservative of assumptions, it will reach 50 percent in the next two years. In Italy, according to the Internet Media Observatory of the School of Management of Politecnico di Milano, in the first months of 2020, partly due to the lockdown, 59% of Italians used at least one paid video on demand (SVOD) streaming service and 20% used three or more subscriptions at the same time.

Average dwell time on TV Vs OTT in the United States:

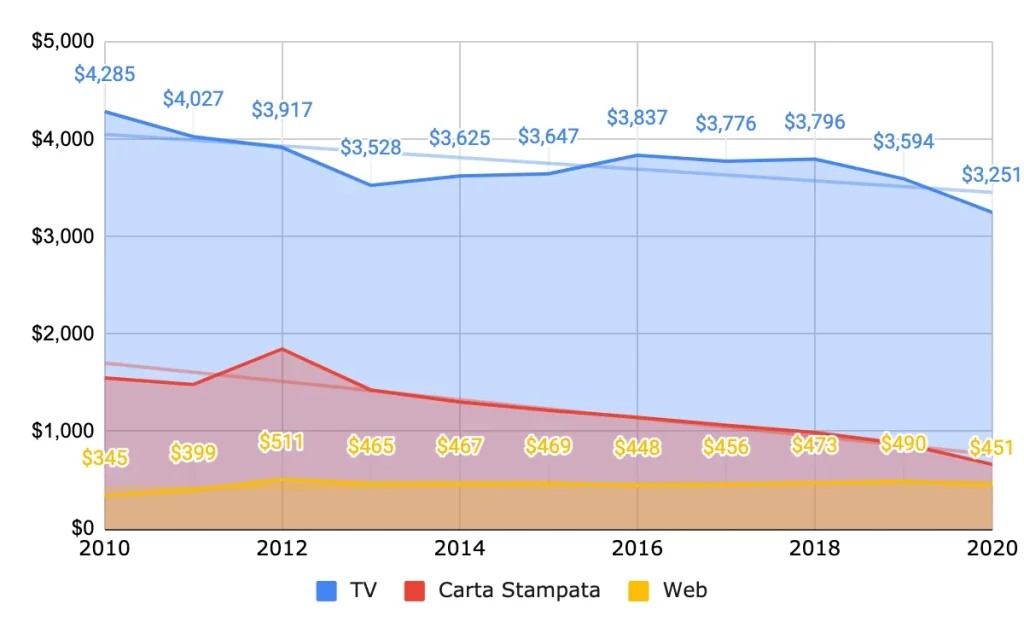

In light of the massive investment in original content by OTTs, it is clear that this trend is likely to increase. The large global platforms will continue in the process ofaudience growth and consolidation in the coming years, going on to intercept television budgets that until now have been an impregnable fortress the exclusive preserve of traditional broadcasters. The implications for traditional TV are easily foreseeable. Let us prepare for a dramatic acceleration of a vicious cycle we have been witnessing for more than a decade now. Fewer viewers will lead to reduced advertising revenue, meaning fewer resources to invest in original content and a consequent, gradual extinction of TV as we have known it to date.

Advertising budget trends in Italy, OTT excluded (in billion euros):

A decisive push in this direction is Agcom’s June 10, 2021 resolution. The resolution focuses on the need for unified audience measurement of all players with the goal of providing advertisers with a transparent view of the distribution of TV audience in Italy across all existing devices and platforms. This means that the TV audience on OTT platforms such as Amazon Prime Video, Netflix, YouTube, Apple, Twitch, TikTok, Disney+, as well as the audience that transits on video content integrated within publishing sites, will be equated with that of national broadcasters. Beginning in September as primaonline reports, DAZN will take a first step toward the new directive by adopting a mixed system involving Auditel measurement of audience on digital terrestrial and TIM Vision and to Nielsen’s processing of web and app streaming performance. Audience unification is a momentous breakthrough that will lead to a direct comparison between the ability to attract viewers’ attention on both home screens and on computers and smartphones.

In this context, the survival of domestic broadcasters will depend on their ability to systemize, upgrade, and intercept domestic content needs, but also on their foresight in identifying additional distribution channels for their content. In this respect, the Web is a huge area of opportunity that intercepts 74.4 percent of the population aged two and older, according to an Audiweb survey conducted in April 2021. While the unification of TV data advocated by Agcom will inevitably open the doors of TV budgets wide to OTTs, it will also offer a unique opportunity for collaborations between large national broadcasters and prominent publishing entities. Web publishers enjoy a large and stable video audience that would lend itself well to TV content integration and distribution and would be able to counter the firepower of large OTTs within national borders.

All is not (yet) lost, By a strange twist of fate, the ball is once again in the hands of traditional broadcasters, in the hope that they will be able to find the courage and skills to take on the biggest challenge in their history. TV is dead but the new TV has already arrived.